OUR DAILY THREAD: The K-Shape Of Things To Come

The wealthy have left the atmosphere

THE SET-UP: When an economic recovery “takes shape,” it literally takes shape.

In fact, the transition from recession to recovery generally takes one of five shapes: V-shaped, U-shaped, W-shaped, L-shaped and K-shaped. The V denotes a dip and spike that matches or exceeds the high point before the dip. It’s a full, return-to-normal recovery. The U means the dip lasted long enough to turn a V into a U. The W happens when the economy recovers momentarily and dips again before a full recovery. An L-shaped recovery portends a prolonged recession with a slow, gradual rise that many would see as long-term stagnation. It’s the shape economists dread most.

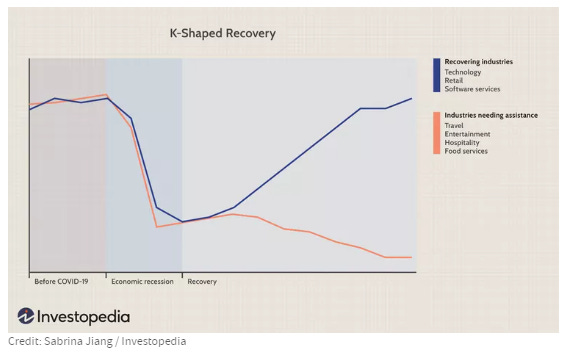

Then there’s the K-shaped recovery.

That appears to be the shape of the US economy’s post-Covid recovery. The upper and lower “arms” on a K-shaped graph reveal an economy split and heading in two different directions. Basically, the recovery bifurcated into winners and losers. Here’s the “bottom line” definition from Investopedia:

A K-shaped economic recovery is where various sectors, industries, and groups within an economy recover at different rates after a recession. This can happen for a number of reasons related to technological and structural change within an economy as well as responses to a recession by policymakers.

Americans avoided the K-shaped recovery after the Crash of 2008. It was U-shaped. The post-Covid recovery, though, looks decidedly K-shaped. Per Investopedia:

Not quite a “K,” but you get the idea. Some industries have recovered and some have not. It is possible that the current “K” is due to the meteoric rise of AI-stoked technology and the market-shaping rise of the “Magnificent Seven” tech stocks.

If so, it might be a transitory bout of “creative destruction” that’s cleaning out dead or dying weight in the economy. Once AI magically transforms everything it touches, those lagging industries will fade out and be replaced by hyperproductive, AI or AI-augmented alternatives.

But what if it isn’t transitory?

What if the K-shaped recovery hardens into a K-shaped economy?

It’s a possibility currently cycling through the news:

MSNBC’s Morning Joe: The K-Shaped Economy

https://stevenrattner.com/2025/10/msnbcs-morning-joe-the-k-shaped-economy/We Have a K-Shaped Economy: Despirito

https://www.bloomberg.com/news/videos/2025-10-20/we-have-a-k-shaped-economy-despirito-videoEvercore ISI’s Krishna Guha: When we look behind macro aggregates, we have a K-shaped economy

https://www.cnbc.com/video/2025/10/17/evercore-isis-krishna-guha-when-we-look-behind-macro-aggregates-we-have-a-k-shaped-economy.htmlThese analysts say the U.S. economy has become “K-shaped.” Here’s why.

https://www.investing.com/news/economy-news/these-analysts-say-the-us-economy-has-become-kshaped-heres-why-4298634

Of those, Rattner’s Morning Joe segment hit the nail on the head:

As most Americans would guess, those at the top have been doing exceptionally well for a number of years. Since 2019, personal spending by those in the top 20% has increased by 49%, well above the 24% increase in prices. All other income groups grew their spending at the inflation rate, meaning that they had no material increase in their consumption. At present, the top 10% of households account for 49% of all consumer spending.

Rattner is not wrong when he says “at present,” but it’s a little longer than that. In fact, that “top 10% = 49% of consumer spending” number was first surfaced by The Wall Street Journal on February 23, 2025. It’s a safe bet that the phenomenon began (at least) a few months before the survey data made it into the Journal’s story. And the longer it goes on, the more likely it is structural rather than transitory.

A Yahoo!Finance piece from October 18th offered corroborating evidence and evidence to the contrary. The headline described a K-shaped spending pattern:

America’s wealthiest shoppers are boosting spending — and the US economy — while lower earners pull back

And they’ve got the numbers to prove it:

In September, spending by households in the top third of the income distribution rose by 2.6% over last year, according to data from the Bank of America Institute published earlier this month. For the lowest third of earners, spending rose a more modest 0.6%.

Yahoo!Finance’s Brooke DiPalma also cited a JPMorgan survey that found…

…higher-income consumers, who feel better about the trajectory of the US economy, plan to increase spending on nonessential goods such as clothing over the next 12 months, compared to middle- and lower-income consumers, who plan to pull back.

To wit, the wealthy are not driving hard bargains:

In the auto industry, the average transaction price of a new car rose to a record high above $50,000 last month, Kelley Blue Book said in a new report. KBB’s Erin Keating said this surge has been “driven by wealthier households who have access to capital, good loan rates, and are propping up the higher end of the market.”

High earners splurged on luxury vehicles in September, like the Cadillac Escalade or Ford’s F-150 pickup truck.

And they’ve got tickets to ride in luxury:

“Our consumer is a high-end consumer ... They’re financially strong. They’ve got the means. They’ve got the interest to travel,” Delta Air Lines (DAL) CEO Ed Bastian told Yahoo Finance last week. Its premium business, like Comfort Plus and Delta One cabins, saw revenue increase 9% year over year in the quarter.

…and…

United Airlines (UAL) CEO Scott Kirby said the company has a higher share of demand among its loyalty customers, who have the means to travel, on an earnings call with investors.

Its premium revenue grew 6% last quarter.

Based on those numbers, it looks like the gap between the K’s upper and lower arms widened over the last year. A senior economist for the Bank of America Institute made that case:

Wages for the highest earners rose 4% over the prior year in September; for the lowest earners, wages rose just 1.4%, failing to keep pace with inflation. “And that divergence has widened really over the last six months or so. So that’s, I think, the primary driver.”

So, those numbers show a year-over-year spike. Maybe it is still just a recent phenomenon. But I refer back to Rattner:

Since 2019, personal spending by those in the top 20% has increased by 49%, well above the 24% increase in prices. All other income groups grew their spending at the inflation rate, meaning that they had no material increase in their consumption.

That’s well-over five years of elevated spending by the top 20%. And 2019 predates the AI frenzy, too. Rattner’s on it:.

Part of what has fueled this explosion of consumption by the wealthy has been the soaring stock market, itself partly due to the excitement around AI. The S&P index has grown by 16% or more in 5 of the past 6 years and is on track to do so again in 2025.

Everyone’s focused on the AI Bubble, but the S&P spike has, as Rattner noted, persisted for six years. And that takes us back to where I think this all started … the Fed’s policy of incredibly easy money after the Crash of 2008.

Investors got the green light via greenbacks and they pumped-up the market.

They pumped-up Silicon Valley.

They pumped-up private equity.

And all the while, valuations grew, stock portfolios grew and wealth amassed in the hands of those who probably had the wherewithal acquire post-crash assets at steep discounts. Basically, Quantitative Easing gave investors a full feedbag and they strapped ‘em on Silicon Valley’s Unicorns. They drove up valuations and stock prices because they had capital to spare. Savvy stock holders borrowed against their skyrocketing tech stocks. It’s a tax-free way to turn stocks into liquidity and then play the market some more. Some even poured money into building the survivalist bunkers they are making necessary both ecologically and politically.

But I digress…

By the time 2019 hit, people of means had a buttload of means at their disposal. The more they invested, the higher their stocks went. At the same time, tent and car-camping favelas popped up in cities and towns around the country. That’s also when the top 20% began its spending spree. - jp

Car loan crisis: More Americans falling behind on loan payments

https://www.wral.com/consumer/5onyourside/car-loan-crisis-americans-behind-payments-oct-2025/

‘Finances are getting tighter’: US car repossessions surge as more Americans default on auto loans

https://www.theguardian.com/business/2025/oct/17/us-car-repossessions-economy

US car prices reach new high as luxury vehicle, EV sales surge nationwide

https://www.foxbusiness.com/lifestyle/us-car-prices-reach-new-high-luxury-vehicle-ev-sales-surge-nationwide

Ultrawealthy families are pouring billions into private credit and real estate, but cutting back on early-stage startups

https://www.businessinsider.com/wealthy-families-shift-billions-to-credit-real-estate-ditch-startups-2025-10

Miami fintech raises millions to launch exclusive credit card for affluent clients

https://www.bizjournals.com/southflorida/news/2025/10/22/karta-launches-credit-card-raises-millions-miami.html

A new take on conspicuous consumption: falling prices for luxury goods and soaring prices for ‘experiences’

https://www.paminsight.com/twn/article/new-take-conspicuous-consumption-falling-prices-luxury-goods-and-soaring-prices-experiences

Global luxury market hits US $ 1.5 trillion as experiential spending surges

https://apparelresources.com/business-news/retail/global-luxury-market-hits-us-1-5-trillion-experiential-spending-surges/

How Wealthy Collectors Are Navigating A Changing Art Market

https://www.forbes.com/sites/forbes-research/2025/10/22/how-wealthy-collectors-are-navigating-a-changing-art-market/

The latest consumer luxury item: butter

https://www.marketplace.org/story/2025/10/06/why-is-butter-the-newest-luxury-consumer-item

This is an excelent piece connecting the dots that most economic coverage misses. The Evercore ISI observation about looking behind macro aggregates is crucial because the headline numbers hide massive divergence. Your point about this starting long before AI, back to the QE era after 2008, really nails it. When the Fed flooded markets with cheap money, it went straight to asset holders while regular people got stuck with stagnant wages. The numbers are stagerring: top 20% spending up 49% since 2019 while everyone else just kept pace with inflation. That's not a temporary blip, that's structural. The luxury spending surge you documented, from $50k+ cars to premium air travel, shows the top tier has completly decoupled from the rest of the economy. At some point this breaks, either through political upheaval or some kind of forced redistribution.