DAILY TRIFECTA: You Know Who Doesn't Deny Climate Change? The Insurance Industry

Follow The Fleeing Money

TITLE: Imperfect storms: Flood of insurance cancellations wreaks financial challenges for churches in Texas, Louisiana and beyond.

https://christianchronicle.org/imperfect-storms/

EXCERPT: The Wall Street Journal recently published a lengthy story detailing the woes of the insured and insurers. Homeowners nationwide have experienced rate increases. Some of the biggest companies have taken major financial hits. Farmers pulled out of Florida, and last year, State Farm stopped offering homeowners coverage in California when the state denied its rate increase request. Others are expected to follow.

Loretta Worters, spokeswoman for the Insurance Information Institute, said rate increases have been most aggressive in California, Florida and the Gulf Coast in general. But she added, “It’s not specific to churches. It’s just properties at risk for wildfires, hurricanes, tornadoes” and similar events.

And last year saw more similar events than any year on record.

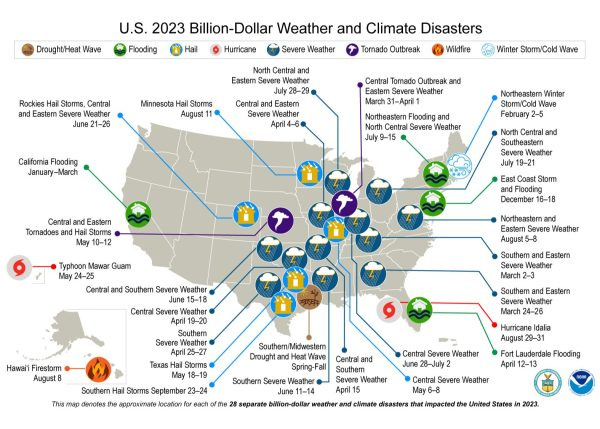

The National Oceanic and Atmospheric Administration reported a record number of billion-dollar disasters in the U.S. in 2023 — 28 in all. That includes a hurricane in Guam and fires in Hawaii. But the other 26 cut a swath across the country stretching from Texas to Maine, including flooding, hail, fire, a hurricane and severe weather events in summer and winter, leaving destruction and soaring insurance costs in their wake.

In central Texas, the Robinson Church of Christ in Waco was able to keep its premium the same after being dropped by Church Mutual and switching to GuideOne. But the church’s deductible increased to $40,000 because the policy calculates deductible as a percentage of coverage of the property.

The congregation has about 80 members, much smaller than before the pandemic, but its building seats 400. Tracy Mueck chairs Robinson’s church council, which handles administrative functions for the elders. She said, “We’re looking at what we need to have in surplus because we do live in a highly susceptible area for wind and hail.”

In West Texas, Suzetta Nutt, executive minister for Abilene’s Highland Church of Christ, said the church did not expect to be dropped by Church Mutual when it got an email hinting at a problem Sept. 28 of last year and one confirming the nonrenewal about two weeks later.

“They said they were declining to cover churches primarily in Texas and Florida because of the amount of weather-related claims those two states are experiencing,” Nutt said.

TITLE: Location, location, location: Why experts say climate risk should also factor into where you live

https://globalnews.ca/news/10245018/location-location-location-why-experts-say-climate-risk-should-also-factor-into-where-you-live/

EXCERPT: In the United States, the First Street Foundation, a research and technology nonprofit working to define America’s climate risk, has hydrologists on staff to go county by county across the country to see how extreme weather is affecting property values.

The head of climate research at First Street, Jeremy Porter, says more than 3.2 million people have left communities affected by weather extremes, leading to so-called “climate abandonment areas.”

Many of those places are nowhere you would expect – like Miami, Houston or San Francisco, the obvious places for risks like hurricanes, devastating storms or extreme fires.

Instead, people are abandoning less high-profile communities that are at high risk of weather extremes. These include sparsely populated parts of the Midwest or in ‘Tornado Alley.’ The reason, Porter says, is there’s less incentive for people to stay put in communities that have fewer economic opportunities.

In other words, no sun, sand – or significant economic growth to keep people staying despite extreme weather risks.

But First Street predicts that in the not-so-distant future, risky areas, such as the beach in Fort Myers that got obliterated by hurricane Ian in 2022, might also turn into ‘climate abandonment’ areas.

“Over the next 30 years, our projections are that some of these risky growth areas in the south and in the west are going to start to also look like these Midwestern areas,” Porter said.

So what is a prospective homeowner to do? In the absence of readily accessible data, Bakos says, ask a lot of questions.

“You want as much information as possible when you’re looking at buying a home – whether it’s in a floodplain location, a (wildfire) interface development,” said Elton Ash, the former executive vice-president of RE/MAX Canada, in one of his last interviews before retiring last fall.

“Awareness is building and people are becoming much more conversant and talking about environmental impact and how that can affect their home choice.”

The real estate industry is also acutely aware that climate change as a risk factor can no longer be ignored.

In the U.S., real estate agencies such as Redfin are increasingly showing a ‘climate risk’ score alongside their MLS listings. The First Street Foundation’s riskfactor.com app allows buyers and sellers to plug in an address and get a climate risk analysis of their property.

TITLE: The world being on fire is swelling ‘catastrophe bonds’ to a record $45 billion—and it’s a key hedge fund strategy

https://fortune.com/2024/01/21/hedge-funds-climate-change-catastrophe-bonds-disaster-insurance-record-high/

EXCERPT: For hedge funds, the science of catastrophes helped generate the best returns of any alternative investment strategy last year.

The calculus around natural disasters such as hurricanes and cyclones fed record gains at funds managed by firms including Tenax Capital, Tangency Capital and Fermat Capital Management. All three delivered results that were more than double an industry benchmark, according to public filings, external estimates and people familiar with the funds’ numbers.

Behind those record returns were bold bets on catastrophe bonds and other insurance-linked securities. So-called cat bonds are used by the insurance industry to shield itself from losses too big to cover. That risk is instead transferred to investors willing to accept the chance that they may lose a part of — or all — their capital if disaster hits. In exchange, they get rewarded with outsize profits if a contractually pre-defined catastrophe doesn’t occur.

Last year, everything came together for those investors in a uniquely profitable cocktail.

“I don’t think we’ve seen a market like this since cat bonds were born in the 1990s,” said Toby Pughe, an analyst at Tenax. The London-based hedge fund’s portfolio of about 120 of the securities delivered an 18% return last year.

The best hedge fund strategy of 2023 was a bet on insurance-linked securities (of which catastrophe bonds are the dominant sub-category), which generated over 14%, according to Preqin, a consultancy that provides data on the alternative asset management industry. Preqin’s benchmark return for the industry — across strategies — was 8%. That compares with a 19.7% gain in the Swiss Re Global Cat Bond Performance Index Total Return.

Cat bond issuance has been turbo-charged by concern about extreme weather events fueled by climate change, and by decades-high inflation that’s added to the cost of rebuilding after natural disasters.

But the seeds of 2023’s record cat-bond performance were planted several years ago.

The securities were generally a dud bet as recently as 2017, when several large hurricanes slammed into the US and investors were called on to cough up the cash needed to cover property losses. Returns were also underwhelming in 2019 and 2020.

Then, hurricane Ian hit Florida in September 2022.

Ian was the most destructive storm in the state’s history, causing $100 billion in losses of which only 60% was insured, according to Munich Re. The event led insurers to shift more of the risk on their books to the capital markets. And with much higher reconstruction costs amid rampant inflation, the stage was set for the market for cat bonds to come roaring back.

“The increase in insured values on the residential side went from 8% to 20%,” said Jean-Louis Monnier, global head of insurance-linked securities at Swiss Re. “Insurance companies needed to buy more cover.”

In 2023, cat bond issuance reached an all-time high of $16.4 billion, including non-property and private transactions, according to Artemis, which tracks the market for insurance-linked securities. Those deals brought the total outstanding market to a record $45 billion, it estimates.

To mop up the influx of newly-issued risk, cat bond investors demanded — and received — much bigger returns. Spreads — the premium over the risk-free rate that investors get paid to take on “catastrophe” risk — reached a high in early 2023. Returns were then amplified by a relatively benign US hurricane season, meaning fewer trigger events and more money for investors.

Greg Hagood, co-founder of Nephila Capital, a $7 billion hedge fund specializing in reinsurance risk, said that last year’s spreads “were probably the highest they’ve been in my career, relative to the risk we’re taking.”

Dominik Hagedorn, co-founder at Bermuda-based Tangency Capital, said hedge fund interest in insurance-linked securities has picked up “quite significantly” over the past 12 to 18 months. “Given where the spreads are at the moment, I wouldn’t be surprised if that stayed like that for another year or so,” he said.

The impact of global warming on weather patterns is a key feature of cat bond modeling, with recent changes setting the stage for new patterns of loss.

Karen Clark, a pioneer in modeling catastrophe risk, says there is increasing market interest in so-called secondary perils, such as severe convective storms, winter storms and wildfires, because that’s where the demand and opportunities are.

“Climate change is having the biggest impact on wildfires,” where individual events will lead to losses ranging from $10 billion to $30 billion, said Clark, co-founder of Boston-based Karen Clark & Co. “That’s where the cat bond market can grow.”