DAILY TRIFECTA: Trump Doesn't Jump Sharks

He goes into business with 'em

THE SET-UP: “Jump The Shark” is an oft-used and misused phrase taken from a two-part episode of Happy Days in which the Fonz accepts a challenge to jump over a shark in water skis.

At the time, Happy Days was in its fifth season, languishing in the ratings and, it seems, running out of ideas. And that’s where “Jumping The Shark” comes in … it’s that moment when you know you’ve run out of ideas, but you’re unwilling to bow out gracefully. Instead, you stretch the plot and the bounds of credulity in a sad effort to keep the sitcom (or, perhaps, your political grift?) going.

“Jumping The Shark” came to mind when I saw Trump’s tweet over the weekend “introducing the launch of our Official Trump Coins!” Per Trump, the coin is “the ONLY OFFICIAL coin designed by me—and proudly minted here in the U.S.A.” If you’re interested, the coin is a steal at just $100. And I think we know who’s doing the stealing.

But is this an example of “Jumping The Shark”?

It’s hard to say, because history indicates Trump hasn’t lost the plot. In fact, stretching the bounds of credulity has always been integral to his plot. Good taste and propriety have never limited the ways Trump can and will monetize his brand … whether it’s steaks or cryptocurrency or NFT trading cards or influence over US foreign policy. His superpower is shamelessness and it negates the “before and after” moment that comes when the hero finally jumps the shark.

Actually, Trump will jump any shark for a buck. And he’ll swim with ‘em, too.

The 9/11-implicated Saudis have been particularly open to Trump’s shark-friendly approach. And, it seems, they are eternally grateful. In July they invited Trump Tower to set-up shop in Jeddah … and they’ve even delivered professional golf to his doorstep. They didn’t even try to hide that quid pro golf. It’s insulting.

The ultimate irony of this unamusing sitcom is that we all might be paying for his repeated inability to close the deal with the NFL. It might even be funny if it joke wasn’t on us.

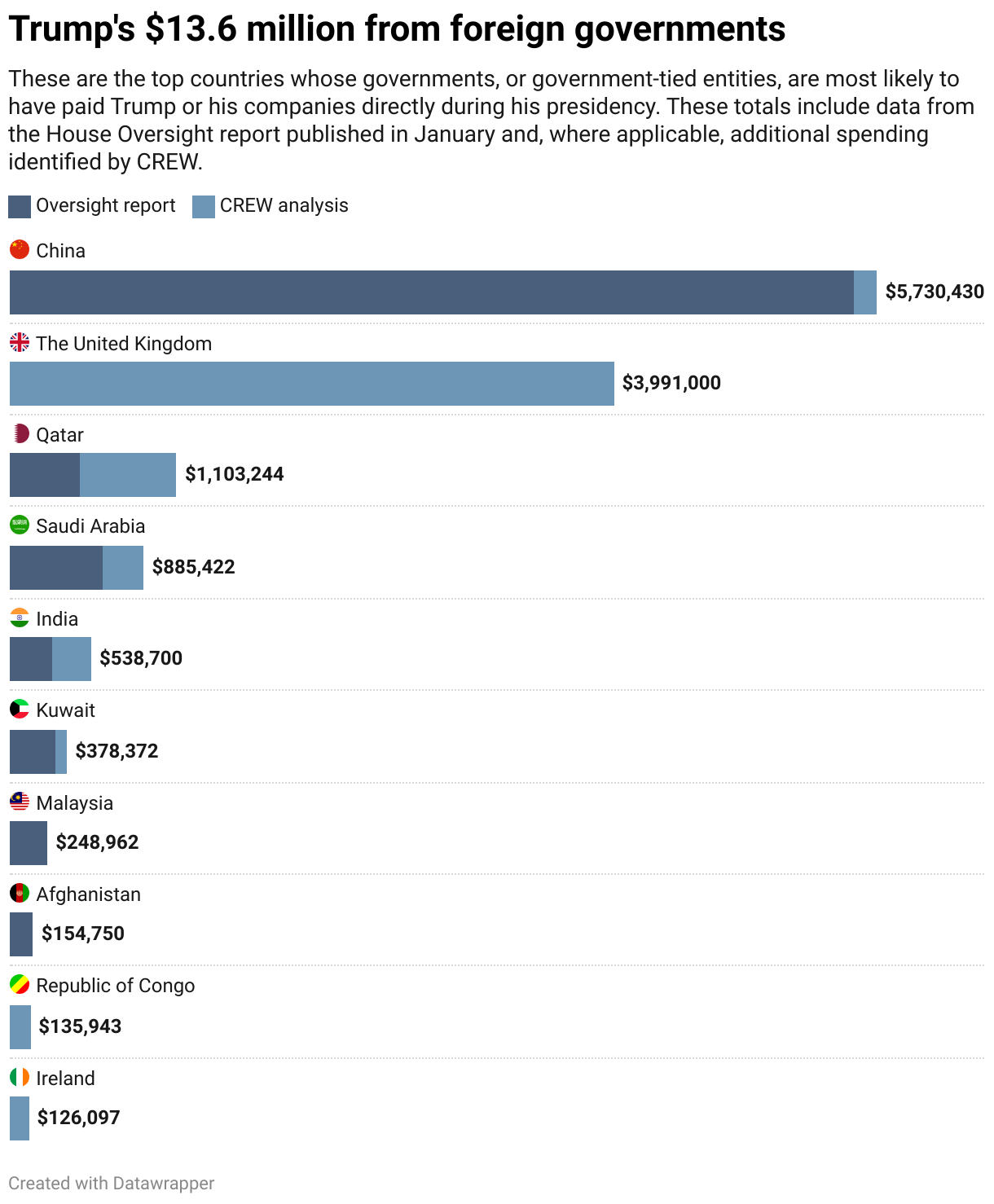

TITLE: Trump likely benefited from $13.6 million in payments from foreign governments during his presidency

https://www.citizensforethics.org/reports-investigations/crew-reports/trump-likely-benefited-from-13-6-million-in-payments-from-foreign-governments-during-his-presidency/

EXCERPTS: Throughout Donald Trump’s time in the White House, he likely benefited from $13.6 million in payments from foreign governments, according to a new analysis by CREW. These payments represent an unprecedented violation of the Constitution’s Foreign Emoluments Clause and serve as a reminder of the further violations Trump is poised to bring into office should he return to the White House.

This report builds on the work done by the House Oversight Committee earlier this year, which relied heavily on an incomplete set of documents provided by Trump’s accounting firm. To make up for the gaps in that information, CREW has pieced together additional details, where available, from our extensive tracking of the ways foreign governments used Trump’s businesses to curry favor with him and his administration, while enriching Trump personally. This is the most comprehensive view to date of Trump’s first term foreign emoluments—a staggering picture of corruption that would have been inconceivable to America’s founders.

Since CREW spent Trump’s presidency meticulously tracking the myriad ways his business interests and day-to-day work as president overlapped, we have built on the Oversight report with information gleaned from our research and other public reporting. The funds documented in the Oversight report and further enumerated here represent a best effort to quantify how much Trump likely benefited from foreign government money as president, but even as this analysis goes further than the Oversight report, and makes some assumptions based on scant public information, it is almost certainly a conservative estimate.

The totals in this report are inherently conservative, because Trump’s payments from foreign governments are often hard to quantify, if they can be tracked at all. For example, while in office, Trump received numerous trademarks from countries like China, Brazil and the UAE, while the government of the Irish county where one of his golf resorts resides granted a permit for an expansion of the property. These and other actions on the part of foreign governments are likely worth millions for Trump’s businesses, but the financial benefit is only included in the overall financial tally here if there was a clear, reasonable way to estimate its value. Thus, in addition to noting where our research reasonably pushes the totals higher, we will also highlight where income and benefits are known but difficult or impossible to quantify as a part of our overall total.

As CREW has previously reported, Trump’s own tax returns showed that he made up to $160 million from foreign sources during his time in office—one-tenth of the up to $1.6 billion he made from his businesses over that same time, according to his financial disclosures. That total includes his income from all sources: foreign properties, licensing deals and beyond—not just the foreign government spending we focus on in this report.

Finally, while this report focuses on government spending that Trump benefited from as president, it is not meant to downplay the tens of millions of dollars that Trump brought in from businesses around the world that can’t be traced back to government sources. These business entanglements, whether or not they are tied specifically to government spending, bring with them their own significant conflicts of interest.

TITLE: Trump launches another business full of potential risks and conflicts if he wins

https://www.cnn.com/2024/09/16/politics/trump-cryptocurrency-business/index.html

EXCERPTS: Donald Trump and his children unveiled a new cryptocurrency business…in a virtual address from his Mar-a-Lago estate, the latest venture that stands to benefit the former president as he seeks another four years in the Oval Office.

Details on the new business, which will be called World Liberty Financial, remain limited, but his son Donald Trump Jr. suggested the new company will provide opportunities for people who cannot get financing from traditional banks.

Real estate investor Steve Witkoff…also joined the call and confirmed his involvement. Trump did not divulge the extent of his involvement, though Witkoff said he worked with Trump and his children for nine months on the project. Other details about World Liberty Financial remain sparse, but Trump’s oldest son argued the banking system has become biased and politicized, using his own family’s difficulties getting credit lately as an example.

“This is going to be an evolution,” Trump Jr. said.

In launching World Liberty Financial, Trump and his family are entering a nascent industry that has clashed with federal regulators as it seeks to gain legitimacy. The next president is certain to confront questions about whether to put guardrails around or encourage growth in this burgeoning but highly speculative sector of financial technology.

“He would be in a position to directly impact the fortunes of this company,” said Jordan Libowitz with the government watchdog group Citizens for Responsibility and Ethics in Washington.

Trump, who once dismissed bitcoin as “not money,” has already made several cryptocurrency-friendly policy commitments. He pledged to fire Securities and Exchange Commission Chair Gary Gensler, whose bearish outlook on cryptocurrency has made him a regular target of their scorn, and promised to create a “strategic national bitcoin stockpile.”

“If crypto is going to define the future, I want it to be mined, minted and made in the USA,” Trump told the industry’s largest annual gathering this summer.

His support came as cryptocurrency leaders and investors have donated millions of dollars to his campaign and aligned political committees. Trump’s campaign has not explained the former president’s 180-degree turn on bitcoin or the potential conflicts raised by this new crypto project. Brian Hughes, an adviser for the campaign, told CNN in a statement that Trump “is ready to encourage American leadership in this and other emerging technologies.”

While Trump’s about face on bitcoin was cheered on by the industry, there is growing concern that his personal interest in cryptocurrency is the latest example of a celebrity looking to capitalize on a buzzy new investment opportunity.

“A lot of projects have been building in this space for years with experienced teams and audited systems,” said Gareth Rhodes, an attorney at the regulatory firm Pacific Street and a former financial regulator for the state of New York. “Is this going to be part of that group of companies or is it more of a barometer of his political prospects like a meme coin or his media stock, which fluctuates whether people think he’s going to win the election?”

“Most people I talk to think it’s going to be in the latter camp but they’re waiting to see what the product is,” Rhodes added.

There are also potential security risks of having a president closely involved in an industry that has already suffered serious setbacks from high-profile fraud cases as well as orchestrated hacks by nefarious actors, sometimes in foreign countries.

Nic Carter, a crypto investor who supports Trump, warned on X that the new company would be “the juiciest DeFi target ever” for hackers, using a shorthand term for “decentralized finance.”

“At best it’s an unnecessary distraction, at worst it’s a huge embarrassment and source of (additional) legal trouble,” Carter wrote.

Yadav, the Vanderbilt professor, agreed, saying it could “damage his credibility as the crypto-president if the venture fails or results in members of his voter base losing their funds.”

Already, hackers posted messages on X accounts of Trump’s daughter Tiffany and his daughter-in-law Lara that linked their followers to a fake World Liberty Financial website.

Meanwhile, the biography for the real X account of World Liberty Financial reads like an omen of these potential pitfalls.

“Beware of Scams!” it says. “Fake tokens & airdrop offers are circulating. We aren’t live yet!”

TITLE: Is Trump’s Whole Political Career Just a Cockeyed Revenge Plot Against the NFL?

https://www.rollingstone.com/politics/politics-features/trump-nfl-owner-buffalo-bills-1235105227/

EXCERPTS: Trump showed in his early football dealings the same relationship to the truth that would become a hallmark of his political career, and the same kind of business acumen that led to his six bankruptcies. In 1981, Trump was part of a group that tried to acquire the Baltimore Colts; when the offer was rebuffed, he denied ever making it. Not long afterward, he passed on buying the Dallas Cowboys for $50 million. “In my opinion, only a loser can buy the Dallas Cowboys,” he said. (Today, the Cowboys are worth over $10 billion, perhaps because they had owners other than Donald Trump.) Instead, Trump paid an estimated $9 million for the New Jersey Generals, a club in the United States Football League, a fledgling alternative to the NFL, in 1983. Afterward, Trump quickly announced that he was on the verge of luring legendary Miami Dolphins coach Don Shula to the new, B-league team. “One of the little obstacles is he’d like an apartment in a building I have on Fifth Avenue called Trump Tower,” Trump claimed to sportscaster Brent Musburger. The next day, Shula said he was “not interested in the United States Football League and the New Jersey Generals in particular.”

Trump did manage to recruit former NFL Most Valuable Player Brian Sipe to play alongside Generals running back (and future MAGA candidate for U.S. Senate) Herschel Walker. Trump also tried to woo New York Giants star Lawrence Taylor, promising to keep the negotiations and a $1 million signing bonus secret. According to the USFL history Football for a Buck, Trump “immediately” called “the various New York newspapers,” pretending to be his publicist, “John Barron.” Taylor never played for Trump (though he later backed him as a political candidate).

Meanwhile, Trump was engineering a far bigger — and far more damaging — con. The USFL had early success by playing in the spring, when the NFL season was done and football fans were starved for action. Trump pushed the USFL owners to move to the fall and have their new league take on the powerhouse of pro sports head to head. Trump was clear in his intentions; he wanted the leagues to merge so he could get a big-boy franchise out of it. (“I have the money to get into the NFL,” he told his fellow owners, “and that’s where I plan on being.”) This was the business equivalent of the Charge of the Light Brigade, of Jonestown, of Sid and Nancy at the Chelsea Hotel. Somehow, Trump managed to convince those owners to go along.

It was an instant disaster. The TV networks already had their Sundays filled. The stadiums were already booked for fall football, so the league champion USFL Philadelphia Stars had to play in College Park, Maryland, 127 miles away. In response, Trump and his lawyer Roy Cohn deployed a favorite tactic: They took the National Football League to court, filing an antitrust suit. “Is this action akin to a drowning man grabbing at razor-sharp knives to stay afloat?” a CNN reporter wondered at the time. Well, yes, even though the USFL actually wound up winning. The NFL teams really did collude to keep out competition (they literally had a playbook for doing so, written by a famed Harvard Business School professor, you can read it right here). But the jury also thought the USFL’s Trump-led strategy to play in the fall and directly challenge the National Football League was so insane, they awarded the USFL a whopping one dollar in damages. The USFL had hoped to win as much as $1.69 billion through the suit; they were counting on it, because the shift to the fall had so severely damaged their economic viability. Without that money, the league closed shop. Trump’s scheme to win an NFL team on the cheap had crushed not only his own dream but 13 other franchises.

Trump looked at buying the New England Patriots a few years later in 1988, “but his people told him between the team and the stadium there was $104 million in debt, and that was too much for him to handle,” a source told The Boston Globe at the time. (Trump allegedly had a net worth of $1 billion by then.) Over the years that followed, Trump became close with many an NFL owner, especially the packaging-and-paper magnate Bob Kraft, who eventually bought the Patriots. Kraft’s star player Tom Brady was an even more intense object of fascination. Both in private and in public, Trump would float the idea of the comically-handsome quarterback dating Ivanka Trump. (“Tom Brady would make any father-in-law proud,” he told Playboy.) This kind of talk continued long after Ivanka linked up with Jared Kushner — so much so, it became a running joke in Trump Tower, according to former aide Sam Nunberg: “If Brady came up [in conversation] and Ivanka was in the office, she would talk about, ‘I told you he wouldn’t be a good husband’ or ‘I told you he wouldn’t be loyal.’”

But Trump’s thirst for an NFL connection couldn’t be slaked through chit chat and a little light innuendo. So when the Bills’ longtime owner died on March 25, 2014 — Trump made his move.

What happened next in the spring of 2014 was weird and silly and short-lived. But it provided something of a preview of the decade to come, and how Trump would operate in it: the petty obsessions, the celebrity fights, the flex-in-the-endzone machismo, the run-ins with the law. When Trump tried to acquire the Bills, he inflated his net worth by billions of dollars, part of his ham-handed effort to prove to the NFL that he was rich enough to join the owners’ club. That was one of many, many times he attempted to land a deal by overstating his financial wherewithal, and it was one of the many, many examples the New York attorney general’s office used to prove earlier this year that the Trump Organization had repeatedly, serially engaged in fraud. Trump’s lawyers are appealing, but he’s right now on the hook for $450 million — that’s in addition to the roughly $90 million he owes E. Jean Carroll, and all the other court cases still in front of him, especially if he loses November’s election.

Had Trump’s play for the Bills actually worked out, he might never have been in this position. In fact, he might not have run for president in the first place.

“If he was doing that [owning and operating the Bills] and running that kind of a business, that would have been relatively new for him,” one former Trump associate tells me. “I think it would have been hard for him to then put all his energy into running for president.”

Trump himself said as much in February of 2016, right after a debate with Ted Cruz and Marco Rubio and Jeb Bush and all the rest, amid the campaign that’s upended our politics ever since: “If I bought that team, I wouldn’t be doing what I’m doing.”

SEE ALSO:

Bibles, Sneakers, Silver Coins: Trump's Merch For Sale

https://www.ibtimes.com/bibles-sneakers-silver-coins-trumps-merch-sale-3744233

21 weird items of Donald Trump merchandise to show that the grift is real

https://www.thepoke.com/2024/09/23/21-weird-items-of-donald-trump-merchandise-to-show-that-the-grift-is-real/

Trump Media plummets yet again —at this rate, on course to become penny stock

https://boingboing.net/2024/09/23/trump-media-plummets-yet-again-at-this-rate-on-course-to-become-penny-stock.html