DAILY TRIFECTA: The Windfall Profits Of War

Business Is Ka-Booming!

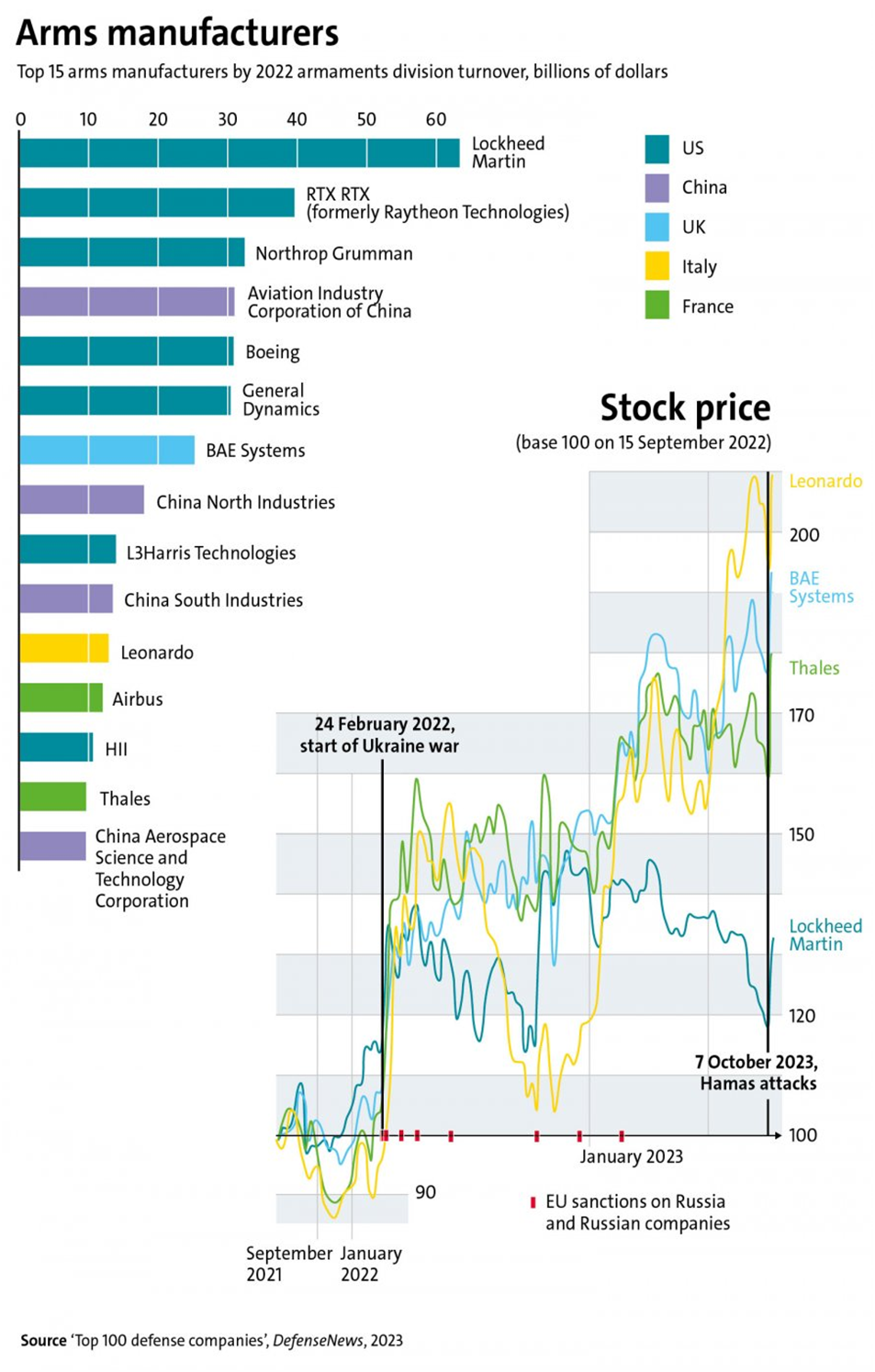

TITLE: Ukraine conflict boosts the business of war

https://mondediplo.com/2024/02/07ukraine

EXCERPT: Arms spending has rocketed since Russia invaded Ukraine, as nations scramble to upgrade their arsenals in a volatile geopolitical climate. For arms manufacturers, this means fat profits.

Global military spending rose for an eighth consecutive year in 2022 to a post-cold war peak of $2.24trn or 2.2% of global GDP, according to the Stockholm International Peace Research Institute (SIPRI). French army chief of staff General Pierre Schill has warned that ‘major wars are back, and once more becoming a favoured way of settling differences’.

Things started to get out of control when Russia annexed Crimea in 2014, and later parts of the Donbass. Since then the world has been rearming. Defence industries have stepped up production and are competing for export market share.

TITLE: House Bill Would Hide Billions More Dollars in U.S. Weapons Sales

https://inthesetimes.com/article/house-bill-would-hide-billions-more-dollars-in-u-s-weapons-sales

EXCERPT: H.R. 6609, the TIGER Act, introduced by Rep. Michael Waltz (R-Fla.), would amend the Arms Export Control Act to increase by approximately 66% the thresholds at which proposed foreign arms sales trigger Congressional notification. This comes as defense industry lobbyists push for expedited weapons sales and deliveries.

Currently, thresholds range from $14 million to $300 million depending on the type of equipment or services and the destination country (NATO members, Japan, Australia, South Korea, Israel, and New Zealand have higher thresholds and shorter review periods). Under the bill, the lowest threshold, for major defense equipment, would increase to $23 million and the highest would increase to $500 million.

According to our analysis of arms sales notifications in 2023, if these new minimums had been implemented last year, at least $635 million in sales would have been exempt from review. That figure includes sales of major defense equipment such as Sidewinder Missiles and Excalibur Tactical Projectiles. The total would likely reach billions within three years.

The current thresholds may already be obscuring as many as 95% of sales, worth billions of dollars. Rep. Kathy Manning (D-N.C.) said at the hearing, “We have seen examples of administrations making below threshold sales to avoid congressional scrutiny.” (Women for Weapons Trade Transparency submitted FOIA requests in March 2022 for data on under-threshold sales — they remain unfulfilled).

Waltz said that the bill would allow the U.S. “to stockpile high demand defense items” and accelerate delivery to key allies. “Nowhere is this more needed than for Taiwan Foreign Military Sales,” he added.

He also argued that the defense industry was losing business: “Because this is such a bureaucratic process we literally have allies buying from other people and other countries rather than us. This is about jobs; this is about empowering allies to fight for themselves.”’

TITLE: China grabs spotlight with major presence at Saudi weapons show

https://www.bloomberg.com/news/articles/2024-02-07/china-grabs-spotlight-with-major-presence-at-saudi-weapons-show

EXCERPT: While U.S. companies like Boeing and Lockheed Martin dominated the World Defense Show in the Saudi capital of Riyadh this week, China’s presence dwarfed that of most other countries.

Exhibiting for the first time under a single brand — China Defense — state companies displayed a range of weaponry, from drones to anti-aircraft and ballistic missiles along with models of stealth fighter jets and amphibious assault ships.

"China has always been an important factor in terms of military exports in the international market,” Sara Zhao, a member of the Chinese delegation, said in an interview. "We see the strong capabilities of the U.S. here, the influence. But there are no problems with China because we always have an attitude of openness to all friendly countries.”

Relations between Saudi Arabia and China have become closer in the energy industry and beyond. The two countries are working to expand cooperation in fields including aircraft, artificial intelligence and infrastructure, and have signed a slew of deals related to refining and petrochemicals businesses over the past year.

Saudi Aramco has been particularly active, buying a stake in one Chinese company last year and talking to two other firms about investments. Riyadh has also said it’s interested in tapping Chinese mining expertise and China’s clean energy firms are looking to Saudi to help globalize their manufacturing bases.

The kingdom may also join the BRICS bloc of emerging nations in a move that would deepen cooperation between the world’s top oil exporter and its largest customer. Saudi Arabia counts China as its biggest trading partner, too, with exchange of imports and exports between the countries amounting to 32.8 billion riyals ($8.7 billion) in November.

But when it comes to defense, China has made only small advances. Saudi Arabia signed $4 billion of new arms deals with China in 2022, including for armed drones, ballistic missiles and anti-drone laser-based systems, Chinese media reported, while refraining from purchasing big-ticket items such as fighter jets.

"It’s clear they have a long way to go,” said Harry Kemsley, president of government and national security at Janes, the U.K.-based defense intelligence firm.