DAILY TRIFECTA: The Economic Hardship-Shape Of Things To Come

Trump goes full Pre-Hamiltonianism

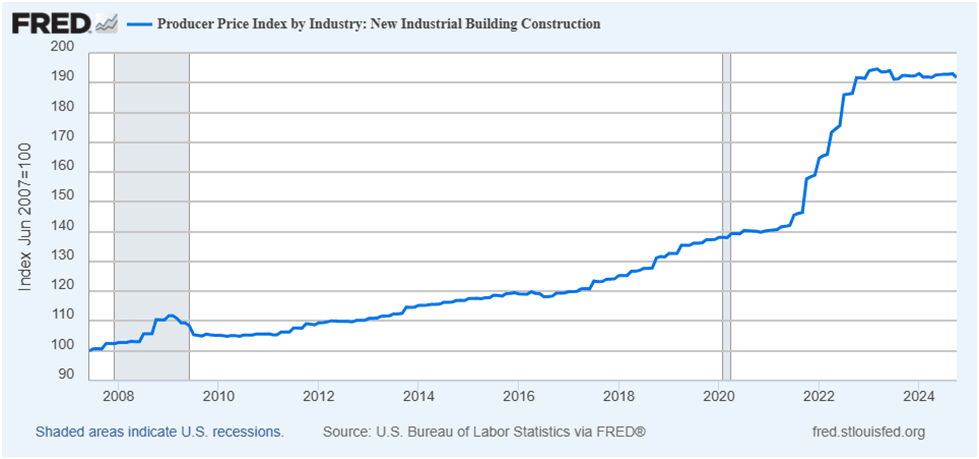

TITLE: Graph: The Enormous Increase in US Manufacturing Construction from Biden’s Green New Deal Policies

https://cleantechnica.com/2024/11/26/graph-the-enormous-increase-in-manufacturing-construction-from-bidens-green-new-deal-policies/

EXCERPT: Democrats couldn’t say it, because “Green New Deal” supposedly became some kind of tainted and negative phrase (I’ll save my rant on how to win messaging battles like this for another day), but the Inflation Reduction Act and Bipartisan Infrastructure Law combined to really basically become the “Green New Deal” our country desperately needed — not just for fighting climate change, but also for creating manufacturing jobs in the United States again. Throw on the CHIPS and Science Act, and Joe Biden and Democrats in Congress did what many Americans have been begging politicians to do for decades — revive or re-inject life into the US manufacturing sector.

We’ve written about this numerous times, and I talked about it at length with Scott Cooney recently in this YouTube video, but humans are very visual, and perhaps there’s no better way to demonstrate this than with a good graph. Luckily, FRED has created one, and CleanTechnica reader “Jason” recently pointed me in that direction. Here’s the graph:

Yes, that’s overall construction spending in the manufacturing sector, but there’s no secret what the spike in spending is coming from.

Interestingly, in that FRED graph, you can see the growth in spending that came under the Obama administration thanks to the American Recovery and Reinvestment Act of 2009 (ARRA) as well, and just as I said in that YouTube discussion, as big and helpful as those green economy policies were, the policies Biden got passed were much bigger. And we’re not just talking about commitments or promises or broad plans, we’re talking about actual construction spending for manufacturing facilities. These factories are getting built.

What you also see is construction spending for new manufacturing capacity was stagnant during Donald Trump’s first presidency. I

TITLE: Trump’s Economic Challenge in Four Charts

https://www.compactmag.com/article/trumps-economic-challenge-in-four-charts/

EXCERPTS: Starting with his first presidential campaign, Donald Trump has made high tariff barriers the centerpiece of his plan to restore US industry. Tariffs give a price advantage to domestic producers over foreign exporters, which creates an incentive to expand capacity and replace imports. But it will take more than tariffs to revive American manufacturing. There are other obstacles, including a tax system rigged against capital-intensive investment. But most important, a decades-long feeding frenzy on imports has hollowed out the labor force, depleted engineering talent, and left in a much reduced state the infrastructure and communities that once made American industry the envy of the world.

The United States has made one major recent attempt to hothouse an industry, namely the Biden administration’s CHIPS and Science Act’s subsidies for domestic production of semiconductors. This prompted a boom in plant construction. But the requisite skilled labor wasn’t available, and the cost of new plant construction jumped by nearly 30 percent between 2022 and 2023. Many CHIPS projects were canceled or delayed for years. The necessary inputs simply weren’t there.

As this makes clear, money by itself isn’t enough. Tariffs give domestic manufacturers a price advantage over foreign competitors, but if the tax system penalizes capital-intensive investment, the educational system doesn’t train workers, and regulators persecute manufacturers, they won’t produce at any price.

The United States has spent the past quarter-century outsourcing manufacturing, neglecting infrastructure, teaching ideology instead of basic skills, and dispersing the communities that once supported manufacturing.

What are the obstacles to expanding US manufacturing? Is it a tax system rigged against capital intensive investment? Is it unstable monetary policy that makes it hard to value assets with a long lifespan? Excessively high interest rates that increase the dollar’s exchange rate and make US goods less competitive? Capricious environmental regulation? Excessive energy costs ? A shortage of skilled labor and engineers? Shrinking federal R&D in high technology? Competition from cheap labor overseas?

If you chose “all of the above,” you get partial credit. China in 2023 had 392 industrial robots for every 10,000 manufacturing workers, as compared to only 285 in the United States. China’s manufacturing sector is more capital-intensive than America’s; last year, the People’s Republic installed more industrial robots than the rest of the world combined.

You need basic high-school math skills (trigonometry and coordinate geometry) to operate a numerically controlled machine, but only 23 percent of US high school students have “basic proficiency” in math, according to the Department of Education. Factories can’t find qualified workers. Engineering schools, for that matter, can’t find qualified applicants. The deterioration starts in grade schools, which are already dealing with a math-teacher shortage. The future isn’t exactly looking bright: The United States awarded just 27,000 bachelor’s degrees in mathematics in 2021.

By my back-of-the-envelope reckoning, America needs to train another 2 million industrial workers and invest about $1 trillion in capital equipment to reverse the quarter-century of rot in manufacturing. There is no magic bullet, just a war of attrition on all fronts.

TITLE: Gold’s Growing Role in Trump 2.0

https://www.jpost.com/business-and-innovation/precious-metals/article-830942

A recent report from T.S. Lombard about The Death of Globalism outlined the anticipated economic recalibration under a potential Trump 2.0 administration. At its core, the analysis predicts a shift in monetary policy to prioritize production and trade over financial dominance. A key takeaway is Trump’s expected push for a weaker dollar, reversing decades of strong-dollar advocacy dating back to the Reagan era.

Quoting the report’s authors, Stephen Blitz and Grace Fan, “The Hamiltonian era of global banking dominance is over… and the Fed will adjust to the new reality of economic priorities.”

This alignment with the administration’s goals implies an era of easing monetary policy. In short, the dollar must decline for Trump’s economic objectives to succeed.

In this new reality, trust is a dwindling commodity. Internationally, fewer nations are willing to lend the U.S. money or buy its bonds at current rates. The result? Rising borrowing costs and a diminished standard of living. If credit dries up, international business must revert to cash-based transactions or strict 30-day settlements.

This paradigm shift extends to U.S. Treasury bonds. Historically, these bonds served as collateral for global trade, their yields generating dollars to fuel economic activity. Without a trusted bond market, global participants will seek a neutral store of value—a void gold is increasingly poised to fill.

A critical point: to address the debt crisis, the U.S. must pivot from financialization to manufacturing. Like a teenager burdened with debt and forced to take a part-time job, the nation must “make and sell actual stuff” to restore fiscal balance. This necessitates a revival of domestic manufacturing and an aggressive export strategy.

This shift aligns with Mercantilism’s principles, prioritizing economic self-sufficiency and trade surpluses. However, achieving this goal involves several challenges, including fostering domestic industries, building global trust, and adopting protectionist measures.

Protectionism, long viewed as a dirty word in free-market orthodoxy, becomes a necessary strategy in a mercantilist framework. Tariffs are the primary tool to protect domestic industries, fostering a manufacturing revival while limiting the disruptive impact of imports. However, tariffs come with unintended consequences, particularly for the dollar and inflation.

Tariffs inherently strengthen the dollar by increasing global demand for it in trade. While this bolsters the U.S. currency, it also creates inflationary pressures domestically and deflationary impacts abroad. U.S. businesses, shielded by tariffs, often raise prices, eroding consumer purchasing power. The challenge is managing these dynamics to avoid destabilizing economic effects.

A strong dollar conflicts with the broader goal of boosting exports. For Trump 2.0’s plan to succeed, fiscal policies like tariffs must be paired with monetary policies aimed at weakening the dollar. This requires Federal Reserve intervention to curb the dollar’s strength, balancing inflationary pressures at home with deflationary pressures abroad.

If executed effectively, this recalibration could spark a manufacturing resurgence, creating a pathway for the U.S. to address its trade imbalances and debt obligations. However, this strategy necessitates a temporary period of elevated inflation as the economy retools itself for production dominance.

In this evolving landscape, gold emerges as a critical player. As trust in bonds erodes, gold serves as a neutral store of value, facilitating international trade. Simultaneously, a protectionist, export-driven economy necessitates a focus on producing goods that the global market demands.

The return to mercantilism implies more than just tariffs—it signals a broader strategic pivot. Protectionism and domestic manufacturing must be supported by monetary policies that ensure the dollar’s competitiveness in global markets. This symbiotic relationship between fiscal and monetary strategies echoes the inflationary cycles of the 1960s and 1970s, suggesting that today’s challenges are not without historical precedent.

This shift will not come without sacrifices. Inflation represents the cost of retooling the U.S. economy into a manufacturing powerhouse. As affluence and wealth are reallocated toward long-term economic sustainability, the nation must embrace short-term hardships.