DAILY TRIFECTA: The Cold War Over A Warming World

Minerals 'R' Us

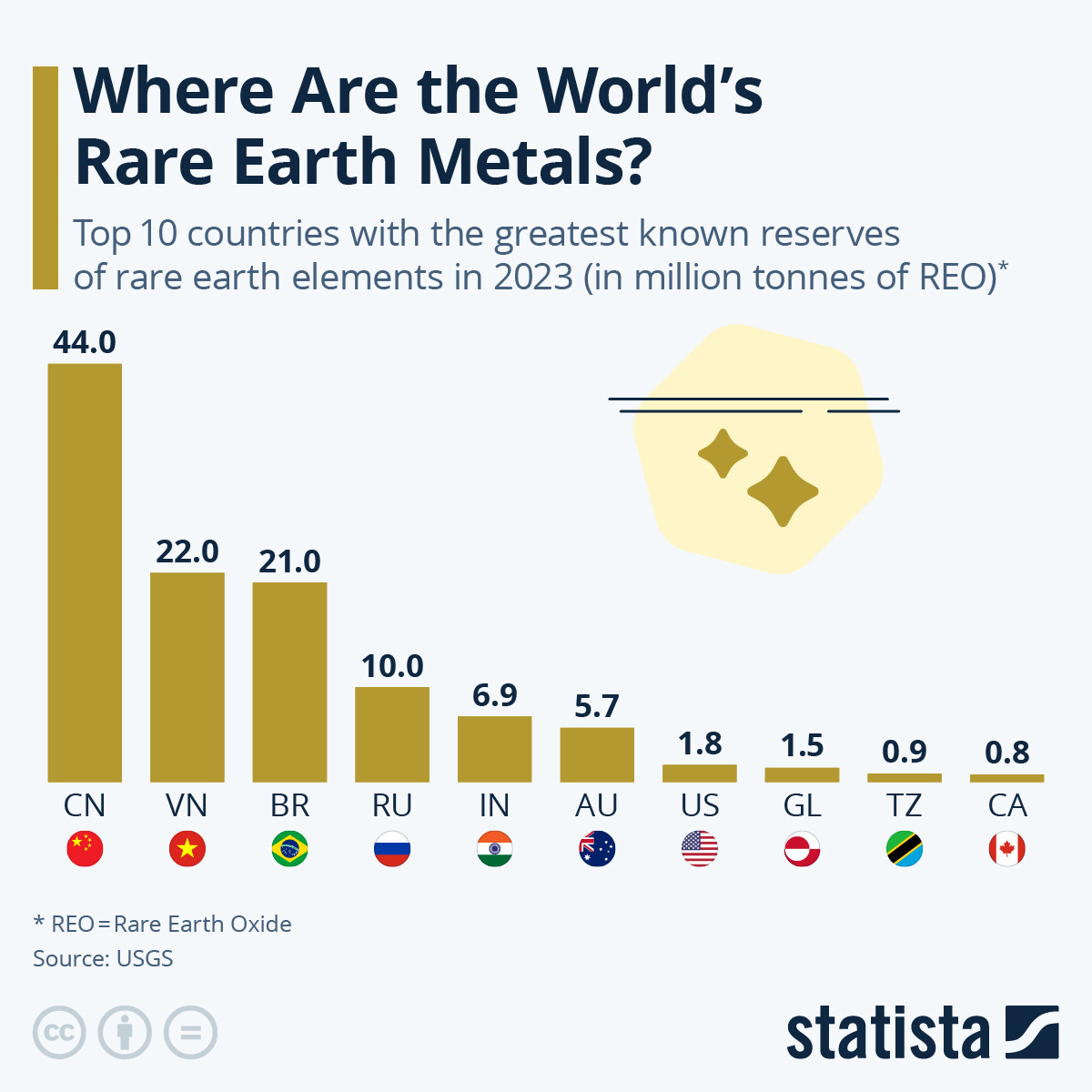

THE SET-UP: There is a delicious irony in Trump’s appetite for Greenland and the unavoidable fact its strategic and economic value is inexorably linked to climate change. The scramble for the minerals Trump covets is due in large part to the escalating demand for the batteries and the technologies driving record growth in renewables. However tacitly (or begrudgingly), he’s catalyzing the “green energy” transition. He’s also responding to China’s massive advantage in solar panel production and green energy storage (batteries), which is matched by its massive supply of rare earth elements. Just see for yourself:

That red and white ball under the “GL” represents Greenland and although their “1.5” pales in comparison to China, that hasn’t stopped China from trying to buy in to Greenland’s mineral sector. Perhaps that because, as Reuters pointed out, Greenland’s mineral resources are “largely untapped.” Reuters also noted a 2023 survey by the European Commission that found “25 of 34 minerals deemed ‘critical raw materials’" were found in Greenland.

Apparently, what Greenland lacks in overall quantity they make up in variety. It’s supposed to be the spice of life. In world where the “New Cold War” is increasingly framed as a fait accompli, it could be the kiss of death. Sadly, that’s how the old Cold War went, with various third party nations swept up in zero-sum games.

That leads to the other irony … that this New Cold War is a fight over who will “win” a warming world of melting ice. The yearly thaw at the top of the world is opening up shipping routes and strategic access to Russian ships and their Chinese partners that used to be frozen-out of the Arctic Circle. Without that “protective ice” there’s nothing to stop the “bad guys” from exploring those waters.

Enter ice sheet-covered Greenland. It’s real estate is perfectly located for the military power “on the go.” I’m sure Trump can see it now … bases and ports right there in Arctic Circle’s melting ice. Location-location-location! And who knows, maybe Barron will eventually build a golf course on some newly-revealed landscape in what may ultimately be called “Greeningland”… that is, if it isn’t under water.

Whatever comes from Republicans in Congress paving the way for Trump’s imperial dream, Trump will never admit his obsession with Greenland is rooted in the realities of a warming climate polluted by hydrocarbon-addicted humans. Then again, wouldn’t it be great if global warming was a Chinese hoax?

Alas, it looks like we are stuck with a Made-in-America reality. - jp

TITLE: Trump dealmaking could shift the cold war over the climate

https://www.brookings.edu/articles/trump-dealmaking-could-shift-the-cold-war-over-the-climate/

EXCERPT: The fight today amounts to a cold war over the climate. Nations are battling for supremacy in innovating, manufacturing, and deploying low-carbon products. They are fighting, too, to corner global supplies of the raw materials—notably copper, lithium, and nickel—needed to make those wares. China, which dominates these industries, heads one bloc in the fight. The United States, European nations, Japan, and other Western-aligned powers coexist, though competitively, in the other bloc.

The weapons in this cold war are policy tools: trade policies, such as tariffs and other fees on imports; tax policies, notably, increasingly large subsidies for domestic production; lawsuits, typically filed against foreign rivals; and diplomacy, including sweeping schemes that aspire to build commercial allies in parts of the world that the partisans regard as economically and strategically vital.

This isn’t purely a governmental battle. If the world musters the trillions of dollars in annual spending widely estimated as necessary to meaningfully decarbonize the economy, private capital will dwarf public spending because government coffers aren’t big enough. Nevertheless, governments are key players in this cold war over the climate because of their role as catalysts: providing concessionary money to prime the pump of market-rate private investment, and promulgating policies that create markets that cause private investors to swarm in.

The cold war over the climate began in earnest two decades ago, in China. Sensing the growing stakes, China started systematically assembling an industrial policy to exploit them. Since then, while Washington equivocated, oscillating between viewing climate change as economically core and economically fringe, Beijing aggressively leveraged a manufacturing base it already had made the world’s factory floor to produce not just t-shirts and toys but also low-carbon technologies.

Today, in essentially every green sector of scale, China dominates the supply chain and, increasingly, the innovation economy. Its firms are racking up records in solar-cell efficiency, and its scientists are doing frontier work on batteries. China’s system of state support for green technologies has often been colossally inefficient, creating some corporate high-flyers that crashed stupendously, and in the process wasting vast sums of renminbi. However, China’s spending has scaled up these technologies for countries around the globe. It has also helped buy China dominance over these global industries at a time when the world is realizing they will be crucial for generations to come.

TITLE: Trump ascendancy casts cloud over Chinese solar firms’ US ambitions

https://www.scmp.com/economy/china-economy/article/3294562/trump-ascendancy-casts-cloud-over-chinese-solar-firms-us-ambitions

EXCERPTS: Hours before American voters began casting ballots in the November 5 election that gave Donald Trump a second term as United States president, the board of leading Chinese solar panel maker Trina Solar decided to sell its newly opened factory in Texas to US battery maker Freyr for over US$300 million.

The price included US$100 million in cash and US$150 million in senior bonds – more than covering its original US$200 million investment – as well as a 19.08 per cent stake in Freyr that will allow Trina to be deeply involved in the US company’s operation and management.

“I think this is a very inspiring case and a good reference for everyone,” Ron Cai, a lawyer with decades of experience navigating US-China business transactions, said as he introduced details of the deal to around a hundred solar industry players in Shanghai in late November.

The audience members were seeking the answer to one question: as uncertainties in the green energy sector and hostility towards Chinese companies rise with Trump’s return, is exploring the US market still worth the risk?

While some companies have put their plans on hold, many others are not willing to abandon what is the world’s second-largest solar panel market after China.

At the same event, Li Deyan, the head of Nanjing-based C&D Clean Energy, said: “In fact, it is only because policies keep changing so that we have opportunities. If policies remain unchanged … we cannot make big money.

“When the US policies are constantly changing, as long as our judgments are accurate, it is actually very easy to create profits.”

After achieving near monopoly status in all links of the solar supply chain, Chinese manufacturers now find themselves trapped in self-defeating overcapacity, with a saturated domestic market and rising trade barriers in foreign markets – especially the US.

Building factories overseas was the solution they grasped, initially eyeing Southeast Asian countries as a detour on the way to the US market. But that route was effectively blocked after Washington imposed anti‑subsidy and anti-dumping duties of up to 271.2 per cent on solar products made in four Southeast Asian countries last year.

That saw investing directly in the US emerge as the most feasible option, with factories springing up across America – from Arizona to Ohio – without much hindrance, even though heightened geopolitical tensions have had an impact on other Chinese-owned businesses operating in the country, ranging from telecommunications giant Huawei to social media platform TikTok.

“Up until now, for the solar sector, the US government does not think the product itself has any problem,” said Cai, a partner at the Shanghai-based Zhong Lun Law Firm.

As US clean energy manufacturing boomed – spurred by lucrative tax credits for US-made solar products that were included in the Biden administration’s Inflation Reduction Act (IRA) in 2022 – the American market presented Chinese manufacturers with a stark contrast to the cutthroat competition at home.

Chinese-backed companies have announced or developed around 26 gigawatts of annual solar module production capacity in the US, where an estimated 40.5 gigawatts of capacity was installed last year.

But that era may come to an end when Trump, a strong supporter of the oil industry, returns to the White House next week, and the Republican Party gains control of both houses of Congress. That could be a double whammy for Chinese-backed solar factories in the US, with the possibility that both “Chinese” and “solar” will no longer be welcomed.

“Conservative thoughts and actions could be advancing rapidly [in the US], including changes in energy policy that involve photovoltaic companies,” said Ocean Yuan, founder and CEO of Grape Solar, a US solar power equipment seller and manufacturer, who is also president of the US China Solar Association.

He said many Chinese solar manufacturers that had plans to invest in the US are uncertain about the road ahead.

If Trump raises tariffs on Chinese products to 60 per cent – as he has threatened to do – that would mean a significant rise in costs for producers in the US who source their raw materials and parts from China, Yuan said.

Last month, Washington announced it would double tariffs on Chinese-made solar wafers and polysilicon – a key raw material in the photovoltaic supply chain – to 50 per cent from the start of this year.

Yuan said the situation was becoming “more and more complex, and both the supply side and the demand side are increasingly anxious”.

TITLE: People are rushing to install solar panels before Trump becomes president

www.npr.org/2025/01/12/nx-s1-5228024/trump-solar-tax-credits

EXCERPTS: The solar power industry is growing fast, accounting for more than half of all new electricity on the grid last year. But soon President-elect Donald Trump and fellow Republicans in Congress may try to reduce or eliminate government incentives that have driven much of that growth.

That has potential customers who want to install solar on their homes worried about the future of an existing 30% federal tax credit. Some are responding by rushing to install solar now, before the credit can be eliminated. Others are deciding solar is too risky with an incoming Trump administration.

Solar installers face even more uncertainty with threats of increased tariffs that could make panels and other equipment more expensive. The industry's main trade group, Solar Energy Industries Association, has released a policy agenda that echoes some of Trump's language, such as "energy dominance." But it's not clear that will sway a president who has been openly hostile to renewable energy.

Trump has suggested tariffs as high as 60% on imports from China and 20% on all other goods coming into the U.S. With the support of a Republican-controlled Congress, Trump also could rescind programs passed as part of President Biden's climate agenda, where allocated money has not already been spent.

At a speech to the Economic Club of New York in September, Trump said he would "rescind all unspent funds under the misnamed Inflation Reduction Act" — that's the Biden administration's climate-focused law, passed in 2022.

It's not clear what Trump's comments mean for clean energy tax credits. His transition office didn't respond to NPR's questions. But the future of these credits is a significant issue for homeowners who want to install solar panels.

Companies that install solar panels say doubts about the tax credit's future, and other actions Trump may take after Jan. 20, are affecting their business. Some installers say they are drafting multiple business plans hoping one will help them respond.

One installer in the Philadelphia suburbs decided to stock up on solar panels now.

"As you can see, we are packed to the gills here," says Doug Edwards, president of Exact Solar as he walks through his company's warehouse in Newtown, Pennsylvania. The space is filled with pallets of boxed solar panels waiting for installation.

Edwards stocked up because of another uncertainty. Trump campaigned on putting 20% tariffs on all goods coming into the U.S.

If that happens quickly — say, in the months between when a job is bid and when it's finished — that could make a solar project unprofitable. By stocking up, Edwards locked in panel prices, protecting both his business and his customers' wallets.

Also in his warehouse there's black metal "racking" for mounting panels on a roof. Some of it is made in the U.S., so it qualifies for higher federal tax credits. Those credits also could be at risk if Trump and Republicans pursue an extensive overhaul of the Inflation Reduction Act.

Edwards says he's hired new workers based on the assumption that such incentives would be around for a decade.

"We've almost tripled in size in the last few years — all local hiring, all local team members," Edwards says, "And we're just hopeful that we won't have to slow that down or have that disrupted in a major way."

While Edwards remains positive about the future of the solar industry, there is a lot of concern that incentive changes and increased tariffs could lead to job losses, or that companies will hire fewer new workers than expected.

Stephen Irvin with Amicus Solar Cooperative says when his more than 80 member companies have to pay higher panel prices, "that means that maybe now they can't hire that extra person they were hoping to. That's a job loss right there."

And Irvin says it's a mistake to see the solar industry as more aligned with Democrats.

"Our companies, and our membership, are spread evenly across red and blue [congressional] districts," Irvin says. "Solar is not just a Democratic issue. It's an American issue."

The solar industry hopes President-elect Trump and Republicans in Congress will come to see it that way too. And leave subsidies in place that encourage more homeowners to install solar power.