DAILY TRIFECTA: Tales From The Crypto Reserve

It's scary

THE SET-UP: Remember when President Trump called Bitcoin a “scam”? It’s true … he said Bitcoin “just seems like a scam" and, more directly, that he didn’t like it “because it's another currency competing against the dollar."

That was his take back in June of 2021.

Like everything the Teflon Don says or does, it did not come back to haunt him later.

Instead, he turned on a dime during the 2024 campaign to embrace Crypto Bros and their crypto tokens. He declared his newfound admiration for all things crypto in July of last year at a Bitcoin Conference in Nashville, Tennessee. Ironically or coincidentally or, perhaps, not coincidentally, the other notable attendee was RFK Jr. … because of course RFK Jr. is a crypto enthusiast. Trump's future Cabinet denizen questioned the sincerity of his future boss’s crypto conversion and rumored proposal to "build a Bitcoin Fort Knox and authorize the U.S. government to buy a million Bitcoin as a strategic reserve asset.”

An early adopter (a.k.a. true believer) in Bitcoin, RFK Jr. reminded the crowd that crypto was more than just a vaporous token floating in the ether, it reflected their values and, he proclaimed, “Bitcoin is about our souls.”

As RFK Jr. anticipated, Trump announced his plans for a crypto reserve and, in so doing, began an increasingly consequential bromance with Silicon Valley’s Tech Broligarchy. Now he’s got Peter Thiel’s protégé in the Veep’s office, he’s got Thiel’s former PayPal partner and fellow South African Elon Musk serving as co-president, and he recently made good on his promise to create a strategic reserve based on five crypto tokens. He announced it in a Sunday post on TruthSocial.

While it’s easy to see the political and financial opportunism behind Trump’s conversion to crypto, economist and former Minister of Finance of Greece Yanis Varoufakis thinks there is a grander strategy at play. And that, in turn, could lead to a Minsky Moment … which isn’t a good thing. Even if Trump’s devaluation scheme goes bust, it’s likely he will not only walk away unscathed, but he’ll make money on the deal. I guess that means the crypto market is, in fact, a lot like a casino. - jp

TITLE: Trump’s crypto time bomb Don't trust his Bitcoin privateers

https://unherd.com/2025/03/trumps-crypto-time-bomb/

EXCERPTS: To recast the global economic order in America’s long-term interest, Trump has a two-pronged, seemingly contradictory, strategy: to devalue the dollar while maintaining its global dominance. By boosting US exports (as the dollar becomes cheaper) while pushing down the US government’s borrowing costs (as foreign wealth piles into US long-term debt), the President seeks to increase US hegemony while also bringing back manufacturing to America. Tariffs, in this context, are the country’s chief weapon, pressurising friends and foes to unload their dollar holdings and buy more long-dated bonds (exceeding 10 years).

But what does crypto have to do with any of this? To get a whiff of the answer, take the case of Japanese banks which hold more than $1 trillion, the result of decades of exports to the United States. Trump wants to bully Tokyo into either investing in the US or dumping most of their dollars into the money markets (thus driving the dollar down) while also not converting them into euros or renminbi (which would risk strengthening the reserve status of rival currencies). What could do the trick? How about convincing, or strong-arming, the Japanese to swap their dollars for crypto? That would work, especially if the Federal Reserve dominated the crypto scene. What else could Trump have meant when asserting in his executive order that the US “has not maximized its strategic position as a unique store of value in the global financial system”?

More intriguingly, four days after the executive order, Trump endorsed stablecoins. In so doing, he added a fascinating new dimension to the idea of forcing non-American institutional investors into moves that serve his economic masterplan.

What are these stablecoins and why are they particularly promising tools for Trump’s twin strategy? Marketed as crypto versions of the dollar, stablecoins such as Tether, USD Coin and Binance are, by design, a contradiction in terms. The whole point of Bitcoin, the first cryptocurrency, was to stick it to the man — to central bankers and their fiat currencies, the dollar chiefly. But stablecoins, which are mainly used for cross-border payments, are dollar-denominated crypto-currencies that offer you the anonymity, versatility and universality of Bitcoin — while also claiming to guarantee full convertibility to the dollar on a one-for-one exchange rate. Indeed, some of the world’s largest banks and financial institutions are keen to issue stablecoins which are popular in emerging markets. Last month, the CEO of Bank of America suggested it might launch its own, following the examples of PayPal, Revolut, Stripe and many others.

But how can stablecoins promise to keep their value tethered to the dollar, and is this promise credible? In theory, this promise can be met if the stablecoin issuer holds, in some vault, one dollar for every token issued. But, of course, holding zero-interest-bearing dollars in a vault would be anathema to any self-respecting financier. So, even if the stablecoin issuer truly owns an equal amount of dollars to the tokens it has issued, it will immediately trade these dollars for some safe, interest-bearing, dollar-denominated asset — like 10-year US Treasury Bills. This way the issuer is true to their word of backstopping their tokens with real bucks while, at the same time, earning interest. It is an arrangement after Donald Trump’s heart and, I believe, at the centre of the idea of his strategic crypto reserve.

By setting up a crypto reserve containing dollar-backed stablecoins, the US authorities are signalling to foreign dollar holders that the US government endorses their ownership of these cryptocurrencies. During upcoming negotiations with various governments, with tariffs dangling like the sword of Damocles above their head, the President will drop subtle hints about how pleased he will be if foreign investors buy these stablecoins using their own dollars. If they do buy them, the dollar supply will increase, the dollar exchange rate will dip, no other fiat currency will emerge as a potential suitor to the dollar’s reserve currency status, and dollar-denominated stablecoins will rise in value. As these tokens will now be worth more than a dollar, their issuer will have an incentive to issue more tokens to restore the one-to-one exchange rate with the dollar. In the process, they will buy, with proceeds from the additional tokens they issue and sell, more long-dated US Treasuries to backstop their increased token supply. Bingo! Trump’s twin strategy is fulfilled: the dollar is devalued while demand for long-term US government debt rises, thus pushing down US Treasury yields and his government’s debt servicing costs.

Upon hearing this, deafening alarm bells should sound in our heads. For if this strategy works, and stablecoins become a pillar of American hegemony, Trump will have planted a time bomb within the foundations of the global monetary system. Monetary history is littered with the corpses of schemes guaranteeing the convertibility of some new-fangled currency with a time-honoured store of value. The Gold Standard itself was such a scheme, the post-war Bretton Woods system another.

Take the latter as an example, which coincided with capitalism’s Golden Age — the Fifties and Sixties. The idea behind Bretton Woods was that the West’s currencies would be tethered to the dollar with fixed exchange rates. Moreover, the dollar itself would be anchored to gold at a fixed conversion rate of $35 to an ounce of the magic metal. As long as the US remained a surplus economy, exporting to Europe and Japan goods and services of greater dollar value than that of its imports, the system worked fine. America’s surplus dollars were sent to Europe and Japan (in the form of loans, aid or direct investments) and then were recycled back to the US with every Boeing jet or Westinghouse refrigerator that European and Japanese customers purchased.

Alas, by the late Sixties, this recycling system broke down irreparably. The US had turned into a deficit economy, flooding Europe and Japan (later China too) with more and more dollars to finance US net imports. Provided that non-Americans were happy to hoard their dollars, there was no problem. But, the more dollars they had, the more sceptical they were that the US government would honour its promise to hand over an ounce of gold to anyone with $35. Indeed, when several “runs” of America’s gold took place, President Nixon tore up the Bretton Woods agreement, ended the dollar’s convertibility to US government gold, and messaged the Europeans in Trumpian style: “the dollar is our currency but it is your problem.”

So, here is the point: if the mighty US Empire, at the height of its world hegemony, could not honour the anchor of the feted postwar financial system, that is the fixed conversion rate, what gives us the confidence to imagine that a private outfit, such as Tether or Binance, can do it sustainably? Nothing! Indeed, logic dictates the opposite because of the structure of the incentives built into Trump’s strategic crypto reserve. Think about it: as more dollars go into stablecoins, US Treasury yields are lowered and the issuers of stablecoins have a stronger incentive to invest in riskier assets. Indeed, they may even risk issuing additional tokens without backing them with additional dollar-denominated safe assets. The more this goes on, the greater the reliance of the US government, and of the global monetary system, on privateers whose incentives are to act less responsibly. Does this classic case of moral hazard remind you of anything? If not, I would recommend watching The Big Short again.

TITLE: Trump’s weird crypto obsession could spark the next financial crisis

https://www.theglobeandmail.com/business/commentary/article-trumps-weird-crypto-obsession-could-spark-the-next-financial-crisis/

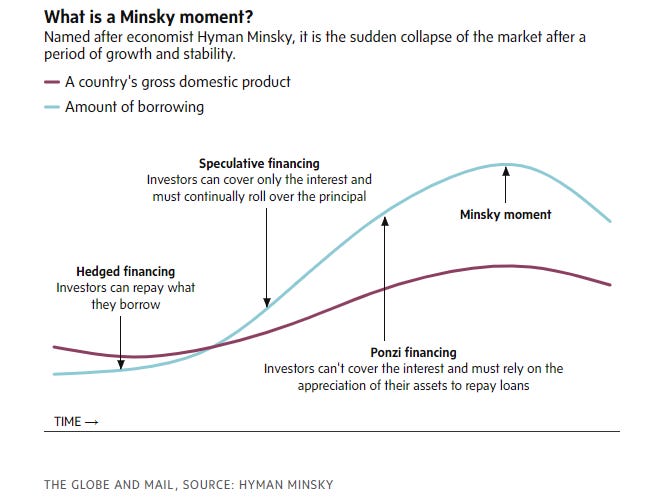

EXCERPTS: You may never have heard of Hyman Minsky, but his influence as an economist surged after the 2008-09 financial crisis. That’s because of his Financial Instability Hypothesis, which holds that in the absence of prudential regulation, financial crises are not just anomalies but inevitabilities.

Prof. Minsky argued that financial markets tend naturally toward instability, as the relentless pressure of competition forces investors into a vicious cycle of ever-riskier trades fuelled by ever-increasing leverage generating ever-growing systemic risk. That leads inevitably to a “Minsky moment,” the point when the market realizes the game is up and everyone rushes for the exits.

Named after economist Hyman Minsky, it is the sudden collapse of the market after a period of growth and stability.

The housing bubble and subsequent crisis seemed to many to confirm Prof. Minsky’s thesis. It had followed a trajectory common in the annals of booms and busts: An irrational herd chases asset prices to unsustainable levels, fuelled by FOMO and imprudent borrowing. Eventually, general risk aversion sets in, teeing up a panic. All that’s needed is a shock – rumours of a major default, a surprise hike in interest rates, a political crisis – to spook the market herd and cue the Minsky moment. Then comes the collapse in prices, the liquidity crisis and recession – U-shaped or V-shaped, depending – topped off by a taxpayer-funded bailout of the people who burned the house down.

The thing to remember about financial crises is that they don’t start when everyone panics and markets collapse. They start long before, often when rent-seeking insiders quietly loosen the bolts of regulation while no one else is paying attention or prevent regulation in the first place, bending public policy toward private advantage in ways that put innocent bystanders at risk.

Something like that seems to be happening with Mr. Trump’s Wall Street nomenklatura. The crypto market is largely unregulated, as demonstrated by the FTX debacle, and extremely volatile, as you might expect of an asset class whose key fundamental seems to be market sentiment. And yet these digital tulip bulbs are an increasingly significant force in financial markets [and the] crypto market opens several avenues of systemic risk.

One is its sheer volatility – 4.8 times greater than that of the S&P 500, according to one analysis. Volatility creates risk aversion and uncertainty, never a good look for public markets or the general economy. The industry’s answer is stablecoins, which are indeed less volatile than altcoins, those other than bitcoin. (An underappreciated contradiction: Stablecoins are reliable stores of value largely to the extent that they are tied to the fiat currencies and central banks that crypto proponents claim to despise.)

Another is market opacity. Initial coin offerings (ICOs) are largely unregulated in the U.S., meaning investors may have no idea who is behind the offering or who’s subscribing, quite unlike highly scrutinized stock IPOs. “Because they are less regulated,” said blockchain law firm Oberheiden, “ICOs are more likely to be used by fraudsters and scam artists who prey on uninformed investors.”

Leverage is also problematic. Some trading platforms allow 100 times leverage, which, as in any other market, amplifies gains but also losses. Excess private-sector debt can steepen a market crash and induce a “balance-sheet recession,” a prolonged downturn caused by individuals and institutions focusing on saving and paying down debt. Saving may sound like a good thing, but in the short term it can hinder aggregate spending, which ultimately is all “the economy” really is, illustrating what economists call “the paradox of thrift.”

Markets are already feeling vulnerable, as shown by the swoon prompted by Mr. Trump’s reckless tariff wars. Stocks are arguably overvalued, and the general economy is vulnerable to a recession, which Mr. Trump at one point conceded is a possibility – before walking it back.

The last thing the U.S. economy needs now or in the long run is a Wild West crypto market liable to implode at any moment. As departing Commodity Futures Trading Commission Chair Rostin Behnam told Politico in January: “We’ve seen this before in our history where we leave large swaths of finance outside of oversight and responsibility, and we have seen time and time again that it ends badly.”

TITLE: How Trump's ties to the crypto world could get even deeper

https://finance.yahoo.com/news/how-trumps-ties-to-the-crypto-world-could-get-even-deeper-130047079.html

EXCERPTS: Donald Trump’s ties to the crypto world might get even deeper if reported talks with Binance somehow lead to a working relationship with the world’s largest cryptocurrency exchange.

The talks — as described this past week in separate stories from the Wall Street Journal and Bloomberg — would have the potential to bring closer together one of the biggest players in the world of digital assets and a US president who has pledged to make America "the crypto capital of the planet."

Trump has already signed executive orders that benefit the industry and has pledged to help push through legislation that the industry favors. At the same time, he has existing interests in other crypto ventures that benefit if the value of digital assets rise.

The discussions thus far with Binance have included a Trump family stake in Binance’s US arm, according to the Wall Street Journal, which reported that former Binance CEO Changpeng Zhao is also seeking a pardon from the administration. In 2023, Zhao pleaded guilty to violating US anti-money-laundering requirements.

Bloomberg reported that the conversations included the possibility of a stablecoin from Binance and World Liberty Financial, a crypto business with ties to the Trump family and the family of Steve Witkoff, the president’s envoy to the Middle East. Stablecoins are pegged to other assets, such as the dollar.

A Trump administration official denied Witkoff's involvement to the Wall Street Journal and said he is in the process of divesting from his business ties.

Binance's Zhao, on the social media platform X, denied discussions of a business deal with World Liberty Financial or a pardon deal for himself with anyone tied to the Trump administration. He also denied that Binance has purchased World Liberty's crypto token.

In a post on X, World Liberty called the reports from the Wall Street Journal and Bloomberg "unsubstantiated," without going into further details.

A closer relationship with Binance, if it were to happen, would give the president even more exposure to the crypto world as he delivers on promises he made to the industry during his first 100 days in office.

AND, as if on cue, we get this news today from CNBC: President Donald Trump’s World Liberty Financial crypto project said on Monday that it raised $250 million in its second token sale, bringing the total amount of coins sold to $550 million.

WLFI, a venture backed by the first family that describes itself as a sort of crypto banking platform, launched in October, weeks before Trump’s election victory. In a document published at the time of launch, WLFI said the Trump family could take home 75% of net revenue.

In Monday’s release, WLFI said more than 85,000 participants underwent so-called know-your-customer verification to gain access to the token sale. Co-founder Zach Witkoff, son of billionaire U.S. envoy Steve Witkoff, is quoted in the release as saying that “WLFI is on track to supercharge DeFi,” or decentralized finance.

In January, Tron blockchain founder Justin Sun upped his stake in WLFI tokens to $75 million. A court filing the following month showed that Sun and the SEC were exploring a resolution to the regulator’s civil fraud case against the crypto entrepreneur.

WLFI is one of several crypto projects in the Trump family that are kicking off just as the president is pushing a crypto-friendly agenda. Earlier this month, President Trump signed an executive order to establish a Strategic Bitcoin Reserve.

According to a memo from the White House last week, David Sacks, the Trump administration’s AI and crypto czar, sold over $200 million worth of digital asset-related investments personally and through his firm, Craft Ventures, before starting the job. Sacks said in a podcast that he “didn’t want to even have the appearance of a conflict.”

At the end of February, the SEC declared that meme tokens are not securities. The announcement came after the president and First Lady Melania Trump launched their own meme coins in the days leading up to the inauguration.