DAILY TRIFECTA: Elon's Snipe Hunt For Healthcare Fraud

Can he "discover" something that's already be found?

THE SET-UP: Here's a two-week old headline:

Rampant Medicare Advantage Fraud Is Staring Musk in the Face. Critics Predict He'll Ignore It

That’s the topper for a CommonDreams story published on February 6th.

In it, Jake Johnson cites predictions by The American Prospect’s David Dayen and by Dean Baker, a senior economist at the Center for Economic and Policy Research. Both noted the relatively ease with which Musk can find data on Medicare fraud. Dayen pointed to the $83 billion of annual fraud detailed in the “latest published report from the Medicare Payment Advisory Commission.” However, Baker was willing to bet that "Elon and the DOGE boys” would somehow fail to “find Medicare Advantage," let alone the well-documented scams insurance companies run at its expense.

Now let’s look at this headline from yesterday:

‘Taxpayer money stolen’: Marjorie Taylor Greene exposes $2.7 trillion healthcare fraud at DOGE hearing

Hooray for DOGE, right?!?

Wrong.

The “fraud” Rep. Marjorie Taylor Greene (R-GA) “exposed” had already been exposed:

The report of trillions of dollars in improper payments, which accumulated since 2003, was published by the U.S. Government Accountability Office in the first half of 2024 -- this was not "just discovered" by DOGE. The estimated total in the report was derived from payments by many federal executive agencies including, but not only, the Department of Health and Human Services, which oversees Medicare and Medicaid.

In other words, it doesn’t seem like we need Elon to save us from rampant fraud because the GAO is already on it. So were Inspectors General (until they were fired in the DOGE purge) and The Wall Street Journal. They seem much more reliable than Musk, who’s currently peddling debunked claims about “fraud” at Social Security.

Musk said Social Security payments were heading out the door to legions of 150+ year-old beneficiaries he called “vampires.” Of course, there are no 150 year-old beneficiaries, so he immediately extrapolated fraud. But there are logical reasons why someone might still be “on the books,” even though they are no longer alive or being paid. Wired explained it thusly:

Computer programmers quickly claimed that the 150 figure was not evidence of fraud, but rather the result of a weird quirk of the Social Security Administration’s benefits system, which was largely written in COBOL, a 60-year-old programming language that undergirds SSA’s databases as well as systems from many other US government agencies.

Because COBOL does not have a date type, some implementations rely instead on a system whereby all dates are coded to a reference point. The most commonly used is May 20, 1875, as this was the date of an international standards-setting conference held in Paris, known as the "Convention du Mètre."

These systems default to the reference point when a birth date is missing or incomplete, meaning all of those entries in 2025 would show an age of 150.

Wired notes there are other possible explanations for people to remain on the rolls long after they’ve died. Regardless, he could’ve easily seen that neither his “vampires” nor their familiars collected Social Security payments if he’d…

…simply looked up the SSA’s own website, which explains that since September 2015 the agency has automatically stopped benefit payments when anyone reaches the age of 115.

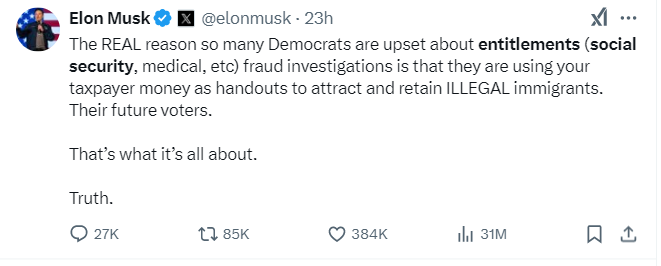

Instead, he barked about it on X … and another mistake (lie?) took root in the minds of a helluva lot of voters who he’s effectively exiled to his virtual version of Oceania. And there, Big Tech Bro can further divorce them from reality with toxic propaganda like this:

He doesn’t really care if it’s the truth or not. He’s lying purposefully. He’s managing perceptions. He’s a reprobate. Unfortunately, the absence of ethics is a competitive advantage in tech. In fact, it feels like it’s become essential. - jp

TITLE: Fraudsters hit exchanges amid Medicare Advantage crackdown

https://www.modernhealthcare.com/insurance/medicare-advantage-marketing-aca-fraud

EXCERPTS: The Centers for Medicare and Medicaid Services implemented regulations earlier this decade to address concerns that beneficiaries shopping for private Medicare plans were being misled and victimized. Meanwhile, health insurers became more bullish about the growing marketplaces, and leading carriers began offering commissions for exchange plan sales, making this market more attractive to brokers and other third-party marketing firms.

Last year, CMS received at least 200,000 complaints from people alleging marketers nonconsensually signed them up for exchange plans or switched their policies. During the open enrollment period that ended last month, the Federal Trade Commission sent letters to 21 marketers and lead generators cautioning them they were under scrutiny.

The sudden proliferation of these incidents led CMS to impose new rules on brokers and other marketers using the federal exchanges. For example, marketers must contact the exchange by telephone when they want to change customers' plans. Despite dire predictions from insurance marketers, the regulations didn't seem to hamper enrollment as sign-ups surpassed 24 million for 2025, breaking a record set the prior year.

The connection between CMS making fraud more difficult to pull off in Medicare Advantage, insurers reducing or eliminating compensation for Medicare Advantage sales, big carriers expanding their exchange businesses, and a flurry of improper enrollments in exchanges plans is clear, said Tim Murphy, an attorney at the law firm Epstein, Becker & Green.

Insurance companies such as CVS Health subsidiary Aetna, Cigna and UnitedHealth Group subsidiary UnitedHealthcare that had not paid for exchange enrollments in the past started to do so for the 2025 sign-up campaign, which induced marketers to shift their attention from Medicare to individual policies, said Justin Brock, CEO of Bobby Brock Insurance, an insurance agency in Tupelo, Mississippi.

Some of those brokers were crooks, Brock said. "Once those commissions started becoming more readily accessible, and people realized how much easier it was to market to people that were under 65, that’s when these large groups exploited the heck out of it,” Brock said.

Mirroring previous trends in the Medicare Advantage market, the increased prevalence of zero-premium exchange plans for low-income people also created an opening for fraudsters, said Sam Melamed, CEO of the dental and vision insurance agency NCD and founder of a social media platform for insurance marketers called Insurance Forums. These bad actors lured customers with misleading promises of cash cards, rent assistance and mobile phones, he said.

Despite intensified scrutiny from CMS and the FTC, the authorities aren't equipped to root out rulebreakers, Melamed said. “You don't have to be a licensed agency to actually participate in the lead gen world. There's not really much enforcement action that CMS or state departments of insurance could have on it,” he said.

At the same time, private equity investors seeking rapid returns on investment gravitated toward health insurance marketers, as they have toward virtually every corner of the healthcare sector.

Bain Capital, for instance, is one of eight defendants in a wide-ranging lawsuit over what the plaintiffs characterize as misleading tactics to collect sales leads and then change enrollees' plans without permission. The case, Turner v. Enhance Health, is before the U.S. District Court for the Southern District of Florida.

Exchange fraud also attracted attention from Republicans opposed to the Affordable Care Act of 2010 at a time when the GOP faces a decision about whether to extend the enhanced exchange subsidies that are due to expire at the end of the year.

Some Republican lawmakers have demanded investigations and suggested exchanges fraud extends beyond dishonest marketers and that a large number of enrollees are improperly receiving subsidies.

“It's important to make sure that policy responses to that bad behavior are focused on the problem, and you don’t trot this out as a reason to fulfill all other policy preferences this administration might have,” said Justin Giovanelli, project director at the Georgetown University Center on Health Insurance Reforms.

TITLE: Pain Clinics Made Millions From ‘Unnecessary’ Injections Into ‘Human Pin Cushions’

https://kffhealthnews.org/news/article/pain-clinics-michael-kestner-made-millions-unnecessary-injections-fraud/

EXCERPTS: Pain MD, which sometimes operated under the name Mid-South Pain Management, ran as many as 20 clinics in Tennessee, Virginia, and North Carolina throughout much of the 2010s. Some clinics averaged more than 12 injections per patient each month, and at least two patients each received more than 500 shots in total, according to federal court documents.

All those injections added up. According to Medicare data filed in federal court, Pain MD and Mid-South Pain Management billed Medicare for more than 290,000 “tendon origin injections” from January 2010 to May 2018, which is about seven times that of any other Medicare biller in the U.S. over the same period.

Tens of thousands of additional injections were billed to Medicaid and Tricare during those same years, according to federal court documents. Pain MD billed these government programs for about $111 per injection and collected more than $5 million from the government for the shots, according to the court documents.

More injections were billed to private insurance too. Christy Wallace, an audit manager for BlueCross BlueShield of Tennessee, testified that Pain MD billed the insurance company about $40 million for more than 380,000 injections from January 2010 to March 2013. BlueCross paid out about $7 million before it cut off Pain MD, Wallace said.

These kinds of enormous billing allegations are not uncommon in health care fraud cases, in which fraudsters sometimes find a legitimate treatment that insurance will pay for and then overuse it to the point of absurdity, said Don Cochran, a former U.S. attorney for the Middle District of Tennessee.

Tennessee alone has seen fraud allegations for unnecessary billing of urine testing, skin creams, and other injections in just the past decade. Federal authorities have also investigated an alleged fraud scheme involving a Tennessee company and hundreds of thousands of catheters billed to Medicare, according to The Washington Post, citing anonymous sources.

Cochran said the Pain MD case felt especially “nefarious” because it used opioids to make patients play along.

“A scheme where you get Medicare or Medicaid money to provide a medically unnecessary treatment is always going to be out there,” Cochran said. “The opioid piece just gives you a universe of compliant people who are not going to question what you are doing.”

“It was only opioids that made those folks come back,” he said.

The allegations against Pain MD became public in 2018 when Cochran and the Department of Justice filed a civil lawsuit against the company, Kestner, and several associated clinics, alleging that Pain MD defrauded taxpayers and government insurance programs by billing for “tendon origin injections” that were “not actually injections into tendons at all.”

Kestner, Pain MD, and several associated clinics have each denied all allegations in that lawsuit, which is ongoing.

Scott Kreiner, an expert on spine care and pain medicine who testified at Kestner’s criminal trial, said that true tendon origin injections (or TOIs) typically are used to treat inflamed joints, like the condition known as “tennis elbow,” by injecting steroids or platelet-rich plasma into a tendon. Kreiner said most patients need only one shot at a time, according to the transcript.

But Pain MD made repeated injections into patients’ backs that contained only lidocaine or Marcaine, which are anesthetic medications that cause numbness for mere hours, Kreiner testified. Pain MD also used needles that were often too short to reach back tendons, Kreiner said, and there was no imaging technology used to aim the needle anyway. Kreiner said he didn’t find any injections in Pain MD’s records that appeared medically necessary, and even if they had been, no one could need so many.

“I simply cannot fathom a scenario where the sheer quantity of TOIs that I observed in the patient records would ever be medically necessary,” Kreiner said, according to the trial transcript. “This is not even a close call.”

Jonathan White, a physician assistant who administered injections at Pain MD and trained other employees to do so, then later testified against Kestner as part of a plea deal, said at trial that he believed Pain MD’s injection technique was based on a “cadaveric investigation.”

According to the trial transcript, White said that while working at Pain MD he realized he could find no medical research that supported performing tendon origin injections on patients’ backs instead of their joints. When he asked if Pain MD had any such research, White said, an employee responded with a two-paragraph letter from a Tennessee anatomy professor — not a medical doctor — that said it was possible to reach the region of back tendons in a cadaver by injecting “within two fingerbreadths” of the spine. This process was “exactly the procedure” that was taught at Pain MD, White said.

During his own testimony, Kreiner said it was “potentially dangerous” to inject a patient as described in the letter, which should not have been used to justify medical care.

“This was done on a dead person,” Kreiner said, according to the trial transcript. “So the letter says nothing about how effective the treatment is.”

Pain MD collapsed into bankruptcy in 2019, leaving some patients unable to get new prescriptions because their medical records were stuck in locked storage units, according to federal court records.

At the time, Pain MD defended the injections and its practice of discharging patients who declined the shots. When a former patient publicly accused the company of treating his back “like a dartboard,” Pain MD filed a defamation lawsuit, then dropped the suit about a month later.

“These are interventional clinics, so that’s what they offer,” Jay Bowen, a then-attorney for Pain MD, told The Tennessean newspaper in 2019. “If you don’t want to consider acupuncture, don’t go to an acupuncture clinic. If you don’t want to buy shoes, don’t go to a shoe store.”

Kestner’s trial told another story. According to the trial transcript, eight former Pain MD medical providers testified that the driving force behind Pain MD’s injections was Kestner himself, who is not a medical professional and yet regularly pressured employees to give more shots.

One nurse practitioner testified that she received emails “every single workday” pushing for more injections. Others said Kestner openly ranked employees by their injection rates, and implied that those who ranked low might be fired.

“He told me that if I had to feed my family based on my productivity, that they would starve,” testified Amanda Fryer, a nurse practitioner who was not charged with any crime.

Brian Richey, a former Pain MD nurse practitioner who at times led the company’s injection rankings, and has since taken a plea deal that required him to testify in court, said at the trial that he “performed so many injections” that his hand became chronically inflamed and required surgery.

“‘Over injecting killed my hand,’” Richey said on the witness stand, reading a text message he sent to another Pain MD employee in 2017, according to the trial transcript. “‘I was in so much pain Injecting people that didnt want it but took it to stay a patient.’”

“Why would they want to stay there?” a prosecutor asked.

“To keep getting their narcotics,” Richey responded, according to the trial transcript.

TITLE: Physician faces decades in prison for $24 million Medicare fraud scheme involving assisted living

https://www.mcknightsseniorliving.com/news/physician-faces-decades-in-prison-for-24-million-medicare-fraud-scheme-involving-assisted-living/

EXCERPTS: The Justice Department said that 69-year-old Alexander Baldonado, MD, of Queens, NY, authorized hundreds of cancer genetic tests and other laboratory tests for Medicare beneficiaries who attended COVID-19 testing events at the long-term care settings in 2020. He reportedly was not treating any of the individuals who attended the events and, in many cases, did not speak to or examine them before ordering tests for them. Baldonado also billed Medicare for “lengthy office visits” that he never provided to the individuals, the DOJ said.

“Several Medicare patients for whom Baldonado ordered cancer genetic tests and billed for office visits testified at trial that they did not know who Baldonado was and had never met or spoken to him,” the Justice Department said in a press release. “Baldonado did not contact the patients after the testing events to review the results of the cancer genetic tests, and, in some cases, the patients never received the test results.”

In addition to conducting the lab test scheme, Baldonado also received illegal cash kickbacks and bribes from the owner of a durable medical equipment supply company in exchange for ordering medically unnecessary orthotic braces for Medicare and Medicaid beneficiaries, the Justice Department said. An undercover video played at the trial reportedly showed Baldonado receiving a large sum of cash in exchange for signed prescriptions for orthotic braces.

Baldonado was found guilty Monday of 10 total counts, including one count of conspiracy to commit healthcare fraud; six counts of healthcare fraud; one count of conspiracy to defraud the United States and to pay, offer, receive and solicit healthcare kickbacks; one count of conspiracy to defraud the United States and to receive and solicit healthcare kickbacks; and one count of solicitation of healthcare kickbacks.

He faces a maximum penalty of 10 years in prison on each count of conspiracy to commit healthcare fraud, healthcare fraud and solicitation of healthcare kickbacks, and five years in prison on each count of conspiracy to defraud the United States and to pay, offer, receive and solicit healthcare kickbacks and conspiracy to defraud the United States and to receive and solicit healthcare kickbacks. A federal district court judge will determine his sentence.

The Department of Health and Human Services Office of Inspector General and the FBI investigated the case.

POSTSCRIPT: It sure seems like the DOJ, the FBI and the now-fired IG all had a handle on the “fraud” thing. It makes you wonder what Musk is really up to. - jp